TALLAHASSEE – Leon County Property Appraiser Akin Akinyemi, PhD, RA, CFA, CMS, announces that the preliminary 2024 tax roll has been submitted to the Florida Department of Revenue and local taxing authorities. Based on market conditions as of January 1, 2024, taxable property values in Leon County increased approximately 10% from 2023 to 2024, with overall market values reflecting an increase of over 7.3%. The assessed value of properties with homestead exemption will not increase by more than 3% above last year’s value.

“Property values in Leon County continue to rise as the supply of homes fails to keep pace with the growing demand. Despite an increase in housing inventory, it is not happening quickly enough to significantly impact prices or accommodate the state’s rapid population influx,” said Akinyemi. “The sustained imbalance between supply and demand is driving up property values. Without an increase in available housing, prices are expected to continue their upward trajectory.”

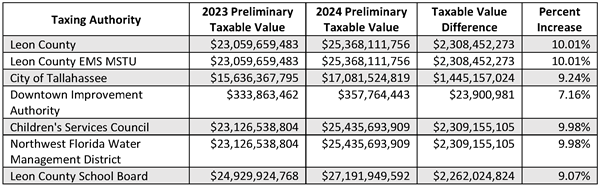

Local taxing authorities, including Leon County, the City of Tallahassee, and Leon County Schools, rely on these preliminary values to determine their proposed millage (tax) rates and to prepare their upcoming operating budgets. In August, property owners will be mailed a Notice of Proposed Property Taxes and Non-Ad Valorem Assessments, also known as a TRIM (Truth in Millage) Notice, that will detail the value of their property, proposed tax rates, and public hearing information.